A foreign entity before entering into a new territory would like to check the business environment, available market, and acceptability of its product, social and economic influencer of any new country.

In India, a foreign company can enter by way of:

Incorporated Entities

Liaison Office (LO) and Branch Office (BO) provide window to foreign investors to have the initial understanding of the business environment in India. The activities that can be undertaken by BO and LO them are specified and they cannot undertake any other activity which is not specified. Project office (PO) is opened for a limited purpose of execution of project and life of project office is limited to the tenure of project.

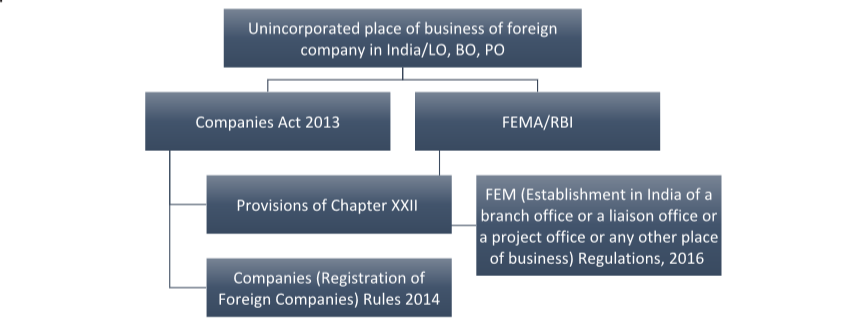

Regulation of LO, BO and PO

LO, BO and PO are unincorporated place of business of foreign company in India and is regulated by the Companies Act as well under FEMA.

We have briefly discussed the provisions of the Companies Act, 2013 below in relation to LO, BO and PO for better understanding. Under the Companies Act, all the unincorporated entities being LO, BO and PO are regulated in the same fashion as the Act does not differentiate on the basis of the purpose for which it is established. Unlike FEMA where different provisions for each of the entity being LO, BO and PO are specified on the basis of activity for which it is established in India.

Regulation under the Companies Act, 2013

Provisions under the Companies Act, 1956: Sections 591 to 602 of the Companies Act, 1956 dealt with foreign companies having a place of business in India. Corresponding to these sections Chapter XXII was introduced in Companies Act, 2013 with additional sections and requirements read with the Companies (Registration of Foreign Companies) Rules, 2014.

Registration under Companies Act, 2013: A foreign company (through LO/BO or PO) shall, within a period of 30 days of the establishment of its place of business in India, file with the registrar Form FC-1 with such fee as provided in Companies (Registration Offices and Fees) Rules, 2014 and with the documents required to be delivered for registration by a foreign company in accordance with the provisions of sub-s (1) of s 380.

Application for registration to be supported by approval from RBI: The above application shall be supported with an attested copy of approval from the Reserve Bank of India under Foreign Exchange Management Act or Regulations, and also from other regulators, if any, approval is required by such foreign company to establish a place of business in India or a declaration from the authorized representative of such foreign company that no such approval is required.

Alteration in the information: Where any alteration is made or occurs in the document delivered to the Registrar for registration under sub-s (1) of s 380, the foreign company shall file with the Registrar, a return in Form FC2 containing the particulars of the alteration, within a period of 30 days from the date on which the alteration was made or occurred.

Accounts and Audit: Every foreign company (present through LO/BO or PO in India) shall prepare a financial statement of its Indian business operations in accordance with Schedule III or as near thereto as may be possible for each financial year and get them audited by a practicing Chartered

Accountant in India.

Filing of financial statement and list of place of business: Every foreign company (present through LO/BO or PO in India) shall file with the Registrar, along with the financial statement, in Form FC.3 a list of all the places of business established by the foreign company in India as on the date of balance sheet.

Our services

• Guidance on Entry Strategies in India

• Filing of Form FNC

• Registration of entry vehicle in India being Liaison office, Branch office, Project office, wholly

owned subsidiary and Joint ventures

• Complete assistance in making Inbound transactions involving structuring, reporting, drafting of

agreements, formulation of exit strategy

• Annual Reporting

Reach Out to Us