All cross-border transactions are managed by the respective foreign exchange laws of the country. The degree of restrictions on cross-border transactions depends on the level of convertibility of currency. Currency convertibility refers to the freedom to convert the domestic currency into other internationally accepted currencies and vice versa. Convertibility in that sense is the obverse of controls or restrictions on currency transactions. While current account convertibility refers to the freedom of currency in respect of payments and transfers for current international transactions, capital account convertibility (CAC) would mean freedom of currency conversion in relation to capital transactions in terms of inflows and outflows.

‘Foreign investment’ is the investment in an enterprise by a non-resident irrespective of whether this involves new equity capital or re-investment of earnings.

Foreign investment is of two kinds:

(i) Foreign direct investment (FDI); and

(ii) Foreign portfolio investment.

FDI is investment from strategic investors; the one who looks for long-term investment in the company, they believe in the growth of the country, the sector and they invest to gain from the overall growth of the country and company, as against portfolio investment by the financial investors, as they hold a short-term view and they want to earn from the ups and downs of the stock market.

The strategic investor makes the investment in the share capital of the company with a view of retaining the shares. The long-term strategic investment by a non-resident shareholder is known as the FDI.

International Monetary Fund (IMF) and Organization for Economic Cooperation and Development (OECD) defines “FDI as a category of cross-border investment made by a resident in one economy (the direct investor) with the objective of establishing a ‘lasting interest’ in an enterprise (the direct investment enterprise) that is resident in an economy other than that of the direct investor”. There is a difference in aspiration with which the two types of investors (direct investors and portfolio investors) invest. Motivation of the direct investor is developing a strategic long-term relationship with the investee so that it can ensure a significant degree of influence in the management of the investee. Direct investment allows the investor to gain access to the investee enterprise which it might otherwise be unable to do, while portfolio investor majorly looks for short-term gains from stock market.

FDI constitutes three components: equity, reinvested earnings and other capital where,

a) Equity: Equity represents the equity share capital in the company.

b) Reinvested earnings: Reinvested earnings represent the difference between the profits of a foreign company and its distributed dividend and thus represents undistributed dividend.

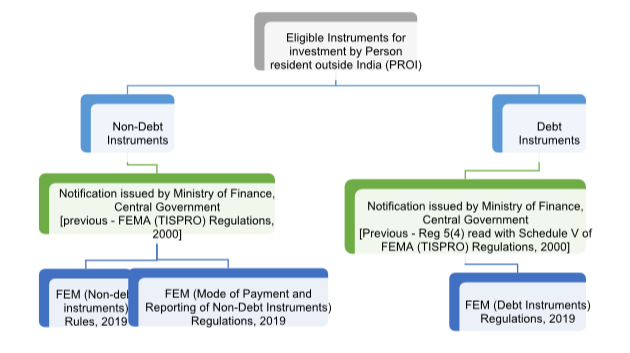

c) Other capital: Other capital refers to the intercompany debt transactions of FDI entities. Governing Regulation: Foreign investment in India is governed by Foreign Direct Investment (FDI) policy as given in the Consolidated FDI Policy by Department for Promotion of Industry and Internal Trade, Ministry of Commerce and Industry. Foreign Investment is a capital account transaction and with effect from 15 th October 2019, powers to regulate Capital account transactions with respect to Non debt instruments have been transferred from the Reserve Bank of India to the Central Government. Pursuant to the transfer of powers, the Government has issued Foreign Exchange Management (Non-debt Instruments) Rules, 2019 (“NDI rules”) with effect from 17th October 2019. The NDI rules have replaced Foreign Exchange Management (Transfer or Issue of Security by a Person Resident Outside India) Regulations, 2017 (“FEMA Notification no. 20(R) dated 7th November 2017”) and also Foreign Exchange Management (Acquisition and Transfer of Immovable Property in India) Regulations, 2018 dealing with Immovable property in India by non-residents.

The present regulatory framework after the change is

Our services

- Assistance in making an investment in India through proper entry strategy and vehicle

- Regulatory compliance and advisory

- Assistance in Filing of various Form

- Representation at Reserve Bank of India

- Representation at Enforcement Directorate

- Evaluation of non-compliance Compounding of all type of offense under FEMA

- Compliance of Reporting requirements Online filing of forms

- Business Valuation as per RBI norms.

- Obtaining permission from the Reserve Bank of India on all matters.

- Assistance in availing of Foreign Funds with guidance on best possible option amongst many like External Commercial Options, Non-convertible debentures, Rupee denominated bonds, etc.

Reach Out to Us