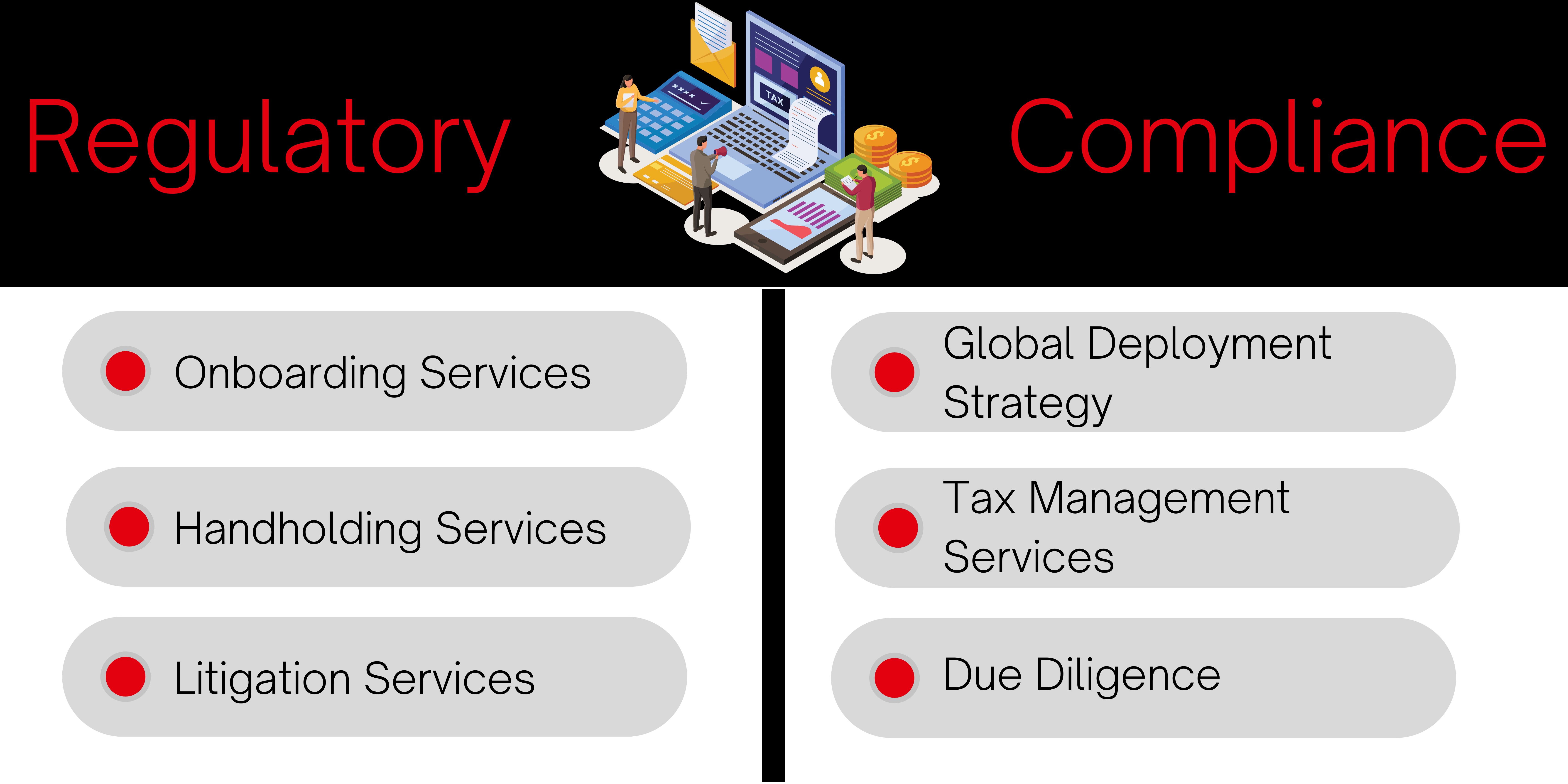

Regulatory & Compliance Box

Regulatory

For an expatriate moving to another country is a challenge itself. This gets added up with tax compliance, procedural compliance, etc. We provide one strop solution for the entry and exit strategy for the expatriates.

Our on-boarding Services shall include:

- Obtaining Permanent Account Number

- Registration with Foreigners Regional Registration Officer

- Advisory & Consultancy

- Surrender of Residential Permit & FRRO registration

- Closure of bank accounts in India and other formalities

- Obtaining No Objection Certificate and Income Tax Clearance Certificate

To create comfort for the expatriates, we provide handholding services. It shall include:

- Computation of income of Expatriates in India

- Filing of Income Tax Return

- Computation of tax to be withheld in India

- Filing Form 67 for Foreign Tax Credit

- Compilation of details of Global income & Foreign Assets

- Obtaining Tax Residency Certificate

Liaisioning with the authorities of different country can be challenging. To reduce the burden and complexity, we provide litigation servics. In which we provide the following services:

- Drafting the correspondence with the Indian Authorities

- Liaisoning with Indian Authorities

- Handling income tax scrutiny assessment proceedings of the expatriate.

Compliance

Expatriates are the essential part of any organisation. There involvement in the organisation, work culture, work arrangement and every other details must be strategised as much as possible. To assist the organisation in the same we provide Global Deployment Strategy Services:

- Advisory & Consultancy

- Planning & Structuring of Expat Models

- Comparative Study of Host & Home Country Laws

- Determination of residential status

- Due Diligence

- Agreements & Documentation

Taxation of expatriate is the same like normal computation of Income and Tax liability but with an additional requirement of grossing-up of tax. Employment Agreement and Tax Equalisation Policy plays an important role to ensure that the employee expatriate should be neither better off nor worse off by taking up an international assignment and therefore he/ she should pay no more or no less tax on the salary income than what would have been payable had the employee continued in the home country. Therefore, having an effective tax management policy for expat employees is must.

Our services includes:

- Drafting of Tax Equalisation Policy

- Timely review of Tax Equalisation Policy

- Drafting of Employment Agreement

- Computation of Hypothetical Tax

- Review of documentation & Agreements

- Advisory & Consultancy

Due diligence refers to complete health check of an organisation. When there are expats in the organisation, it becomes essential to have a complete health check of the organisation from the perspective of expat compliances. Our due diligence services include:

- Reviewing of Agreements between employer & Expat

- Review of computation of income and tax withheld

- Review of Tax Equalisation Policy of the Company

- Analyse the law of host and home country with the income of Expat

- Review of social security benefit availed by an Expat

- Thoroughly review the approvals, regulatory and statutory compliances